This year’s Southeast Asia 500, Fortune’s second annual ranking of the area’s largest companies by revenue, is a snapshot of a region ready to take advantage of global supply chain shifts and booming industries like mining, EVs, and AI—even as U.S. tariff policy threatens to roll back some of last year’s gains.

Companies on this year’s 500 list generated $1.82 trillion in revenue last year, up 1.7% from the year before. That lags the 4.1% GDP growth reported across the seven economies covered in this ranking: Cambodia, Malaysia, the Philippines, Indonesia, Thailand, Singapore, and Vietnam.

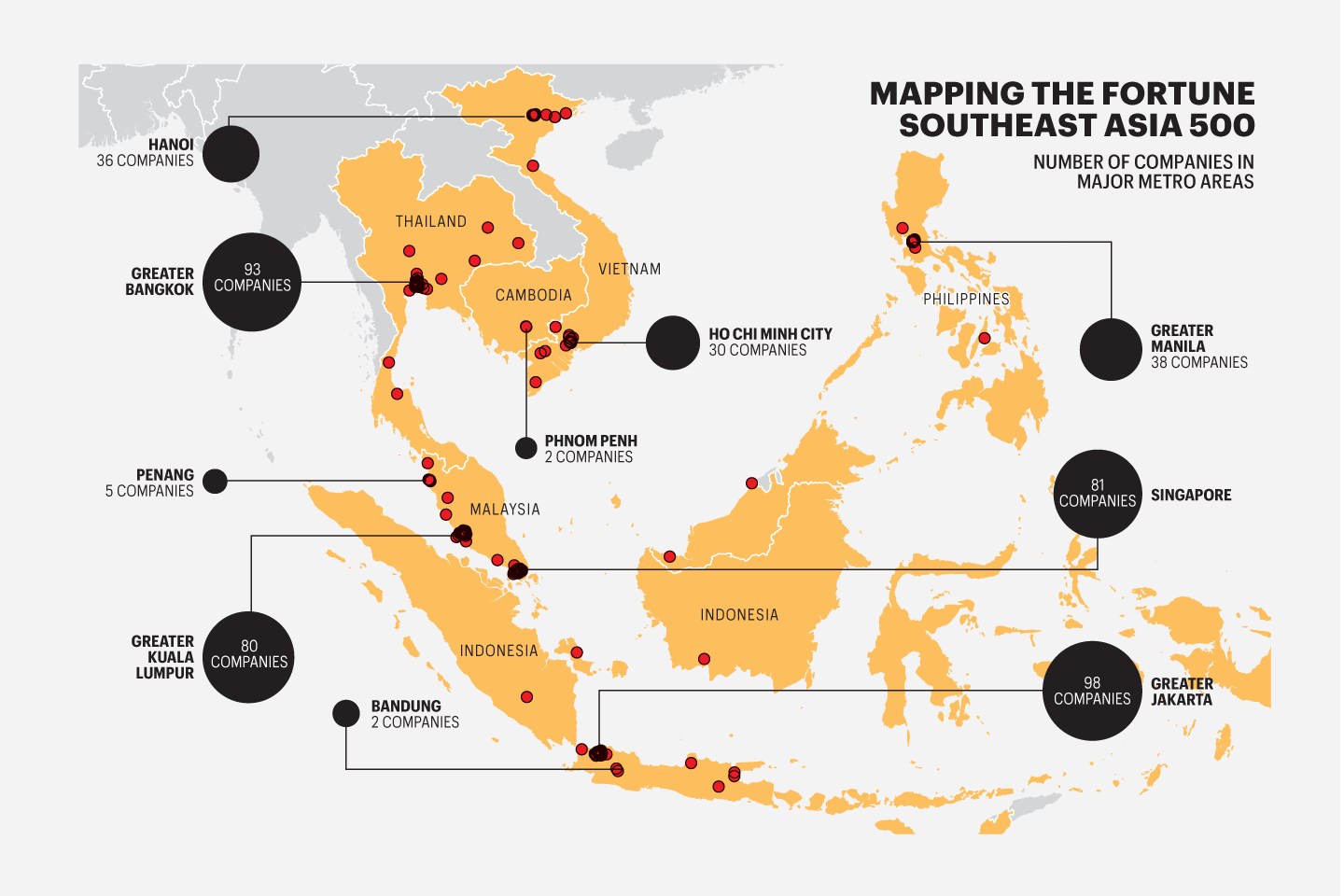

Indonesia, the region’s largest country and economy, has the largest presence on the Southeast Asia 500, with 109 companies; Thailand comes in second with 100. Measure by revenue, however, and the tiny city-state of Singapore takes the lead. Singapore-based companies generated $637.1 billion in revenue last year, just over a third of the region’s total.

The top five companies on this year’s list were big enough in revenue terms to make last year’s Fortune Global 500. They each trade in commodities, whether metals (Trafigura), oil (PTT and Pertamina), or agricultural products (Wilmar and Olam).

No. 6 in revenue this year is Perusahaan Listrik Negara (PLN), Indonesia’s state-owned power company. Its ranking underscores another quality of this list: Energy—whether resource extraction, power generation, or electrical transmission—is the dominant sector on the Southeast Asia 500, generating almost a third of its total revenue. Thai energy company Bangchak breaks into this year’s top 20 with a 47% jump in revenue.

The three most profitable companies on the Southeast Asia 500 are Singapore’s “Big Three” banks: DBS, OCBC, and UOB. DBS, the youngest of the three, takes the lead with $8.5 billion in profits.

Despite predictions of a booming digital economy, tech has a small footprint on the Southeast Asia 500. Just one tech company, the e-commerce and gaming firm Sea, sits in the top 20. The next internet company, ride-hailing platform Grab, ranks much further down the list at No. 128—although it did climb more than 20 spots in 2024.

But Southeast Asia can’t escape the latest tech trends. The biggest revenue jump on the list belongs to Malaysian contract manufacturer NationGate Holdings, No. 243, whose sales jumped by a whopping 723% over the past year, surpassing $1 billion. NationGate’s story is an AI story: As Malaysia and the region try to ride the technology with data centers and new AI startups, companies like NationGate—Nvidia’s sole contract manufacturer in the region, assembling AI servers—stand to benefit.

This story was originally featured on Fortune.com